Order Book & Position Book

Gain powerful insights into market sentiment and trader positioning with Mytgs’s advanced tools.

Understand Market Positioning Like Never Before

What is the MYTGS Order & Position Book?

The MYTGS Order & Position Book serves as a valuable technical analysis tool, offering insights into how other traders are positioned in the market. By understanding these positions, traders can gain a clearer understanding of overall market dynamics. This tool provides a detailed view of how MYTGS traders are currently situated within the market, displaying the distribution of pending orders and open positions across various price levels. The MYTGS Order Book comprises two key components: Open Orders and Open Position data. With this tool, you can easily analyze the distribution of pending orders and open positions for any of the 16 available instruments. Additionally, users have the ability to zoom in and out of the chart, as well as hover over individual bars for more detailed information.

Key Features

Key Features of Mytgs Order & Position Book

Real-Time Updates

Data refreshes every 30 minutes for accurate market insights

Open Orders

Analyze pending buy and sell orders by price levels.

Open Positions

View distribution of long and short positions.

Hover & Zoom Options

Interact with charts for granular data.

Unrealized P&L

Monitor profit and loss distribution for active positions.

16 Instruments

Access data for a wide range of trading pairs.

Support & Resistance

Identify potential price reversal zones.

Customizable Charts

Adjust views to match your trading preferences

How to Use the Mytgs Order & Position Book

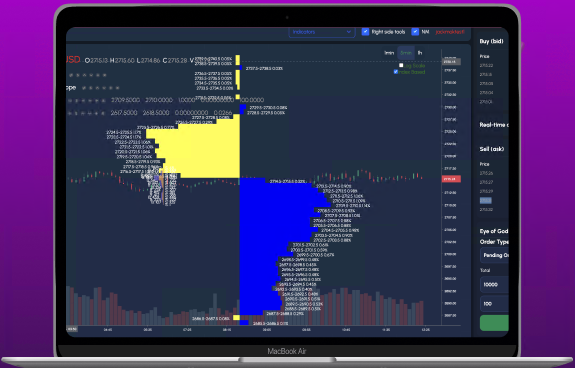

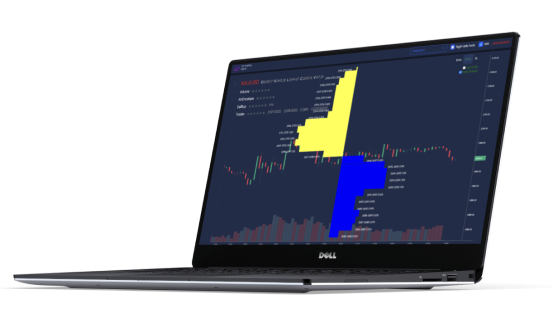

Open Orders

- Visualize buy/sell orders with green and orange bars.

- Breakdown: Buy limit, sell limit, buy stop, sell stop orders.

- Current market price highlighted for easy reference.

Open Positions

- View long/short positions by price level.

- Analyze unrealized P&L and relative proportions.

Why Choose Mytgs’s Order & Position Book?

Identify Trends

Discover market momentum and sentiment

Refine Strategies

Build stronger trading plans with clear data

Stay Ahead

Gain a competitive edge with timely insights

Understanding the MYTGS Order Book and Position Book

Understanding the MYTGS Order Book and Position Book

- The open orders chart displays pending buy and sell orders from MYTGS clients worldwide, organized by price level. Each bar on the chart represents the proportion of buy and sell orders as a percentage of the total across all price levels. Orange bars indicate sell orders at specific prices, both below and above the current market. Blue bars represent buy orders at various prices, also below and above the current market. This chart reflects data from the past 24 hours and is refreshed every 30 minutes. Horizontal lines highlight the current market price. The chart is divided into four sections corresponding to:

- Buy limit orders (below the current market)

- Buy stop orders (above the current market)

- Sell limit orders (above the current market)

- Stop orders (below the current market)

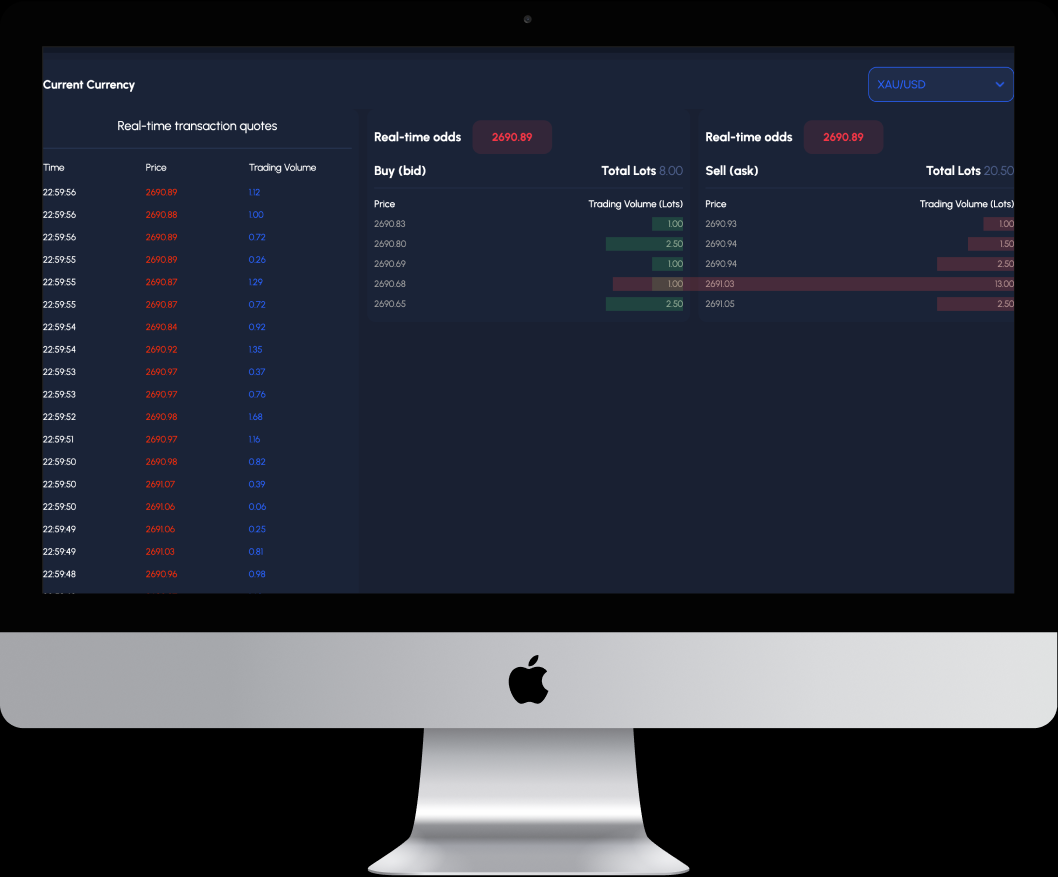

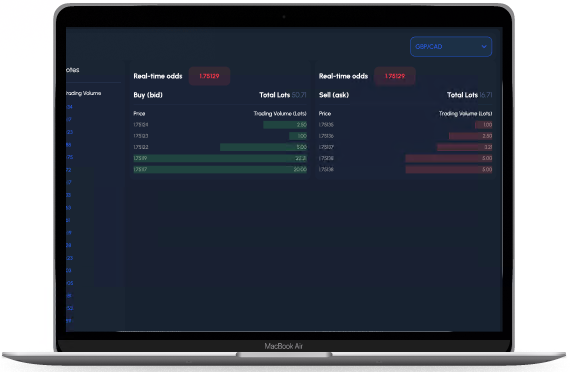

Viewing Open Positions Held by MYTGS Clients

- The Open Position chart illustrates the distribution of open positions held by MYTGS clients globally. Based on the price level, it reveals: The balance of long and short positions Unrealised profit and loss (P&L) The share of total longs and shorts at each price level

- By analyzing the distribution of MYTGS client orders and net positions across price levels, users gain valuable insights that aid in identifying potential support and resistance levels at differing price points.

Start Trading Smarter Today

Unlock the full potential of the Mytgs Order & Position Book. Stay informed, strategize effectively, and make confident trading decisions.